pet insurance no medical history: clear answers for cautious owners

You can still insure a pet even if the vet file is thin. Policies that allow sign-up with no medical history typically shift the verification to later. That can be fine - so long as you know what gets checked, when, and how exclusions work. The goal here is stability and transparency so you can decide with a clear head.

What "no medical history" usually means

It rarely means "no questions asked." It means the insurer doesn't demand full veterinary records at enrollment. Instead, they rely on waiting periods, look-back rules, and pre-existing condition language. Coverage can be solid, but proof of past health may be requested at claim time.

How insurers handle underwriting without records

- Moratorium (no upfront records): You buy the policy, serve waiting periods, and any condition with signs during a defined look-back window is excluded. Records are pulled when you claim.

- Accident-only paths: Many accident-only plans skip records entirely. Illness claims are where history matters most.

- Post-claim verification: For the first substantial claim, expect a request for all notes from each clinic your pet visited within the look-back period.

- Targeted checks: If the claim is for a knee injury, they look for prior limping or contralateral issues. For skin, they scan for chronic itch notes.

- Optional medical review: Some insurers offer a post-enrollment review to confirm exclusions early. Not fun to read, but it reduces surprises.

Waiting periods and look-backs, in plain terms

Typical structures use short waits for accidents and longer waits for illnesses. A look-back window (for example, 6 - 18 months) is used to decide whether signs existed before cover started. If signs were present, the condition is considered pre-existing and excluded. I first called this "no underwriting," but that's not precise - underwriting still happens, just later.

What to expect at claim time

- Record request: Even if they didn't ask at sign-up, they may request records for your first illness claim.

- Timeline: Claims can slow while clinics send notes. To keep momentum, line up vaccination cards, adoption papers, and any prior invoices.

- Outcome: Clean history speeds payment. Gaps get questions; questions aren't denials, but they add time.

Pre-existing conditions: the crux

- Clinical signs vs diagnosis: It's not about the name in the chart; it's whether signs were present before the policy or within the look-back.

- Bilateral issues: One side can implicate the other. A left knee problem may exclude the right knee.

- Chronic vs curable: Chronic conditions are commonly permanent exclusions. Some curable issues may be reconsidered after a symptom-free period.

- New vs recurring: A brand-new, unrelated illness after waiting periods is typically eligible.

A small real-world moment

After adopting a young cat with no paperwork, I bought an illness plan that didn't need records upfront. Seven weeks later, an ear infection hit. The insurer paused the claim and asked the clinic for notes; the vet had only seen her once for a quick intake. We added a brief attestation that there'd been no prior ear issues. Payment cleared two days later. I'd assumed "no records" would mean faster claims - actually, it can be one step slower on the first go.

Costs and trade-offs

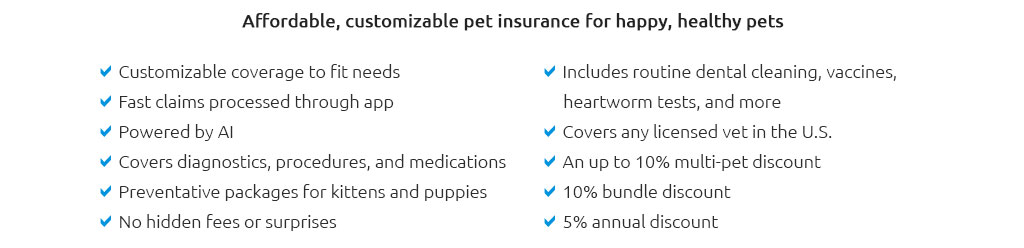

Premiums aren't necessarily higher for plans that skip records at sign-up. The trade-off is uncertainty timing: you learn the precise exclusions at claim or during an optional review. Accident-only is cheaper but narrower. Comprehensive accident-and-illness costs more but offers better long-term stability if the wording is clear.

Markers of stability and transparency

- Clear definitions: "Pre-existing," "clinical signs," "bilateral," and "congenital" are defined plainly in the policy.

- Fixed waiting periods: No moving targets after purchase.

- Explained look-back: The exact window and how it's applied are spelled out.

- Policy sample available: Full terms accessible before checkout.

- Pre-approval option: Ability to submit estimates for guidance before treatment.

- Consistent claims notes: The insurer explains decisions and references the clause used.

Questions to ask before you buy

- Do you require full medical records at enrollment, or only at first claim?

- What are the illness and accident waiting periods?

- What is your look-back window, and how do you define clinical signs?

- How do you treat bilateral conditions and congenital issues?

- Is there an optional post-enrollment medical review to confirm exclusions?

- What documentation speeds the first claim?

- Can I switch plans later without resetting pre-existing exclusions? If not, how are upgrades handled?

Edge cases worth noting

- Switching insurers: A fresh policy means a fresh look-back; prior resolved issues might be treated as pre-existing again.

- Long gaps in care: No vet visits can look like no problems - or simply no data. A baseline exam after purchase helps.

- Behavioral and dental: Policies vary widely. Read those sections closely.

Simple path to a steady outcome

- Gather whatever you have: vaccine cards, prior invoices, shelter intake notes.

- Decide scope: accident-only for budget shock protection, or accident-and-illness for broader stability.

- Prefer clear moratorium wording over vague promises. If offered, request a post-enrollment review.

- Schedule a baseline exam soon after purchase and keep receipts.

- Set a deductible and reimbursement rate you'll actually stick with long term.

The short version: Policies allowing pet insurance no medical history can work well if you accept that proof shifts to claim time. Favor insurers that explain their look-back rules, define terms crisply, and document decisions. That combination keeps the coverage steady and the surprises rare.